The pandemic has accelerated the adoption of digital payments and has led to a significant shift towards online financial services. Paytm’s strong Q4 results come at a time when India’s digital payment and financial services market is growing rapidly. India’s Digital Payment and Financial Services Market However, the company’s management is confident that these investments will pay off in the long run and that it will eventually turn profitable.

The company has been investing heavily in expanding its ecosystem and acquiring new customers. Paytm’s losses were primarily due to its investment in new business verticals, including its e-commerce platform and Paytm Payments Bank. Paytm also reported strong growth in its lending and insurance businesses, which saw a 50% and 77% increase in revenue, respectively.Īlso Read: Google, Microsoft, and Amazon Accelerating an Explosive AI Talent Frenzy in the Booming Indian Market 2023 Paytm’s Investments and Long-term Vision The company’s payment business recorded a 29% increase in transactions during the quarter, while the number of merchants on its platform grew by 52%. Paytm has been expanding its range of services, including wealth management, insurance, and lending, to capitalize on the growing demand for digital financial services in India. The increase in revenue can be attributed to the company’s strong growth in its payment business and financial services. The company’s revenue for the quarter jumped 52% year-on-year to Rs 3,629 crore. The company reported a net loss of Rs 168 crore, which is a significant improvement from the previous year’s net loss of Rs 1,701 crore. Paytm, one of India’s leading digital payment and financial services companies, has announced its Q4 results for the financial year 2022. Today, Paytm has over 350 million registered users and is one of the largest digital payments companies in the world. Since then, Paytm has continued to expand its services and has launched several new products, including a digital wallet, a payments bank, and an online marketplace. This initiative led to a surge in demand for digital payment platforms, and Paytm was one of the biggest beneficiaries. In 2016, the Indian government announced a demonetization initiative, which aimed to reduce the use of cash in the economy and promote digital payments.

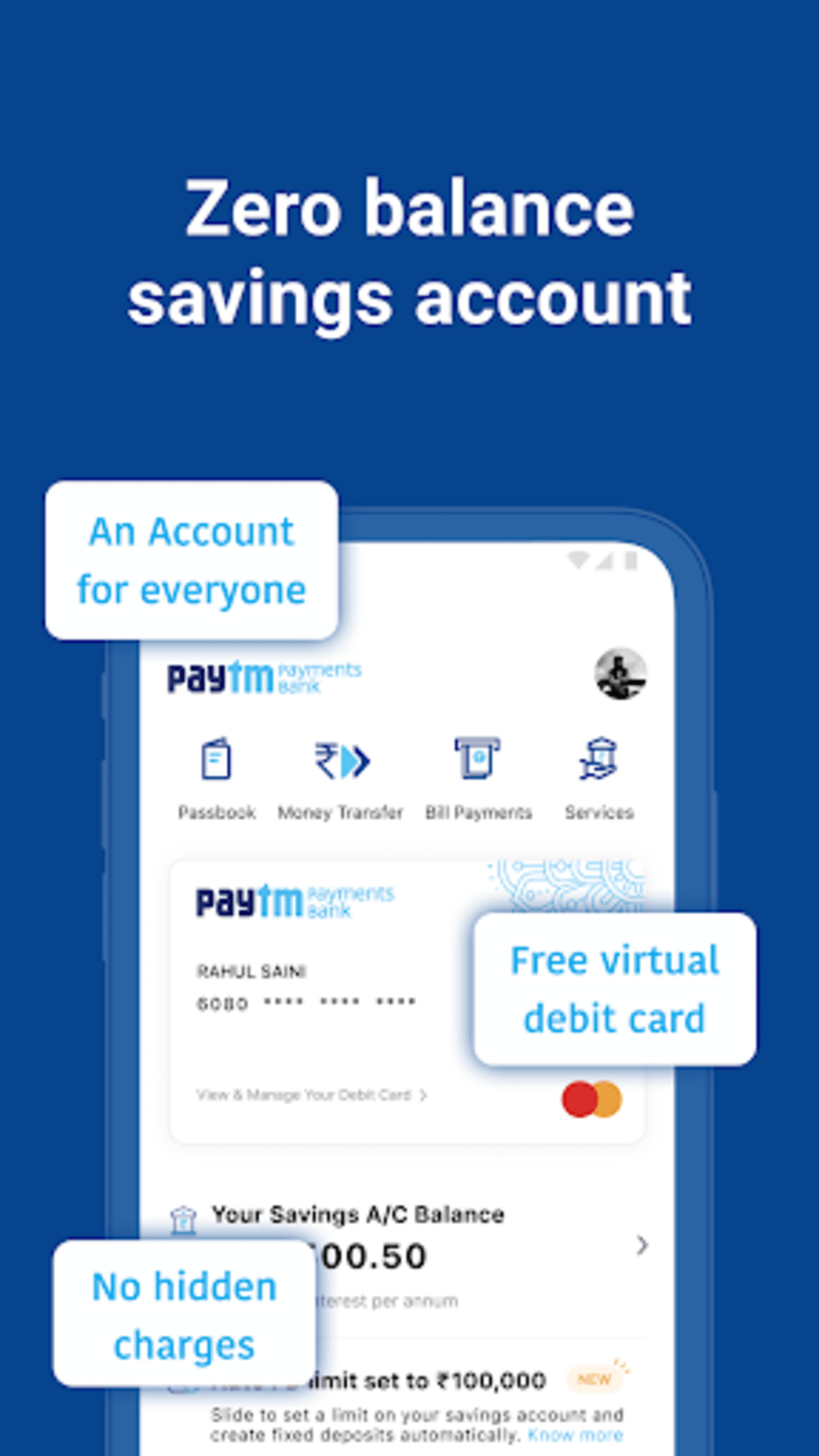

This investment allowed Paytm to expand its services and infrastructure, and it quickly became one of the most popular digital payment platforms in India. In 2014, Paytm received a significant investment from Alibaba Group, which valued the company at over $1 billion. The company’s first product was a mobile application that allowed users to recharge their mobile phones and pay bills for various services, such as electricity and gas. The name “Paytm” is an acronym for “Pay Through Mobile”, reflecting the company’s initial focus on mobile payments. It was founded in August 2010 by Vijay Shekhar Sharma as a mobile recharge and bill payment platform and has since expanded to offer a wide range of financial services, including banking, insurance, mutual funds, and more. Paytm is a digital payments and financial services company based in India. India’s Digital Payment and Financial Services Market.Paytm’s Investments and Long-term Vision.

0 kommentar(er)

0 kommentar(er)